The Road to 2030 is No Easy Street

As the UK moves ever nearer to the 2030 ban on sales of new petrol and diesel vehicles, let’s take a look at the progress of electric vehicle (EV) adoption. This report will answer questions that are crucial to understanding the EV market and accesses how the policymakers and industry as a whole can drive mass adoption. What impact will rising electricity prices have on powering electric vehicles, and how will the increasing supply of used EVs have on used car pricing.

Demand falls as electricity prices soar

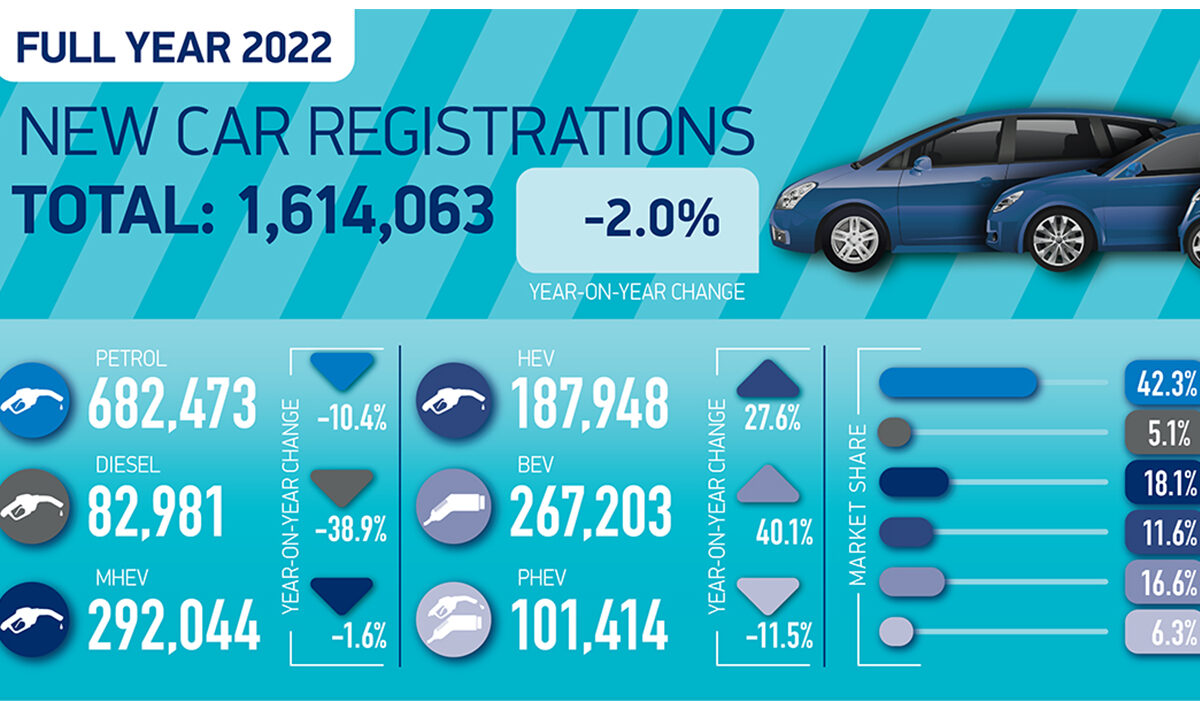

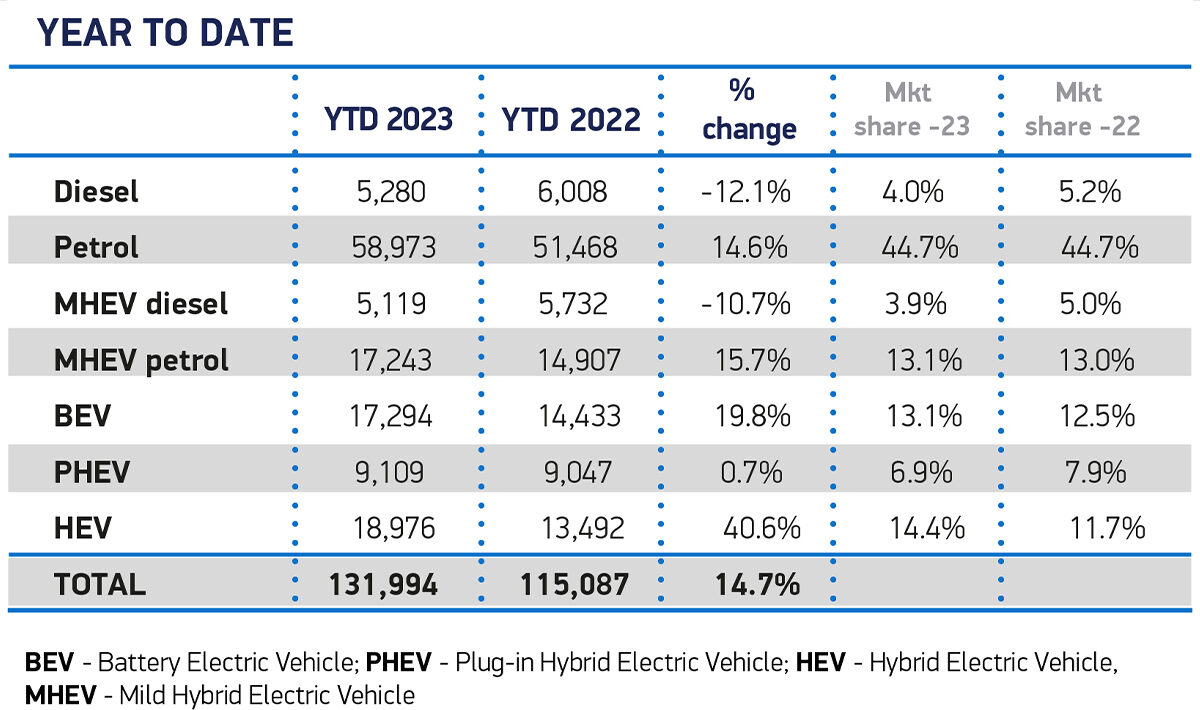

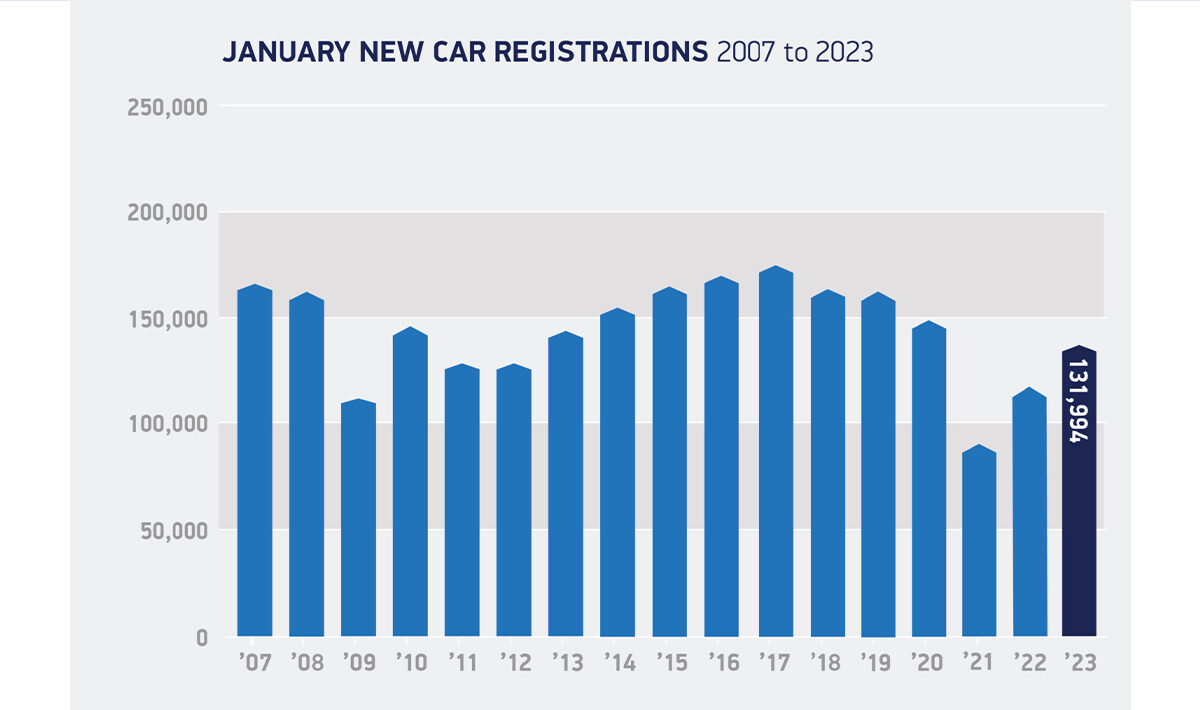

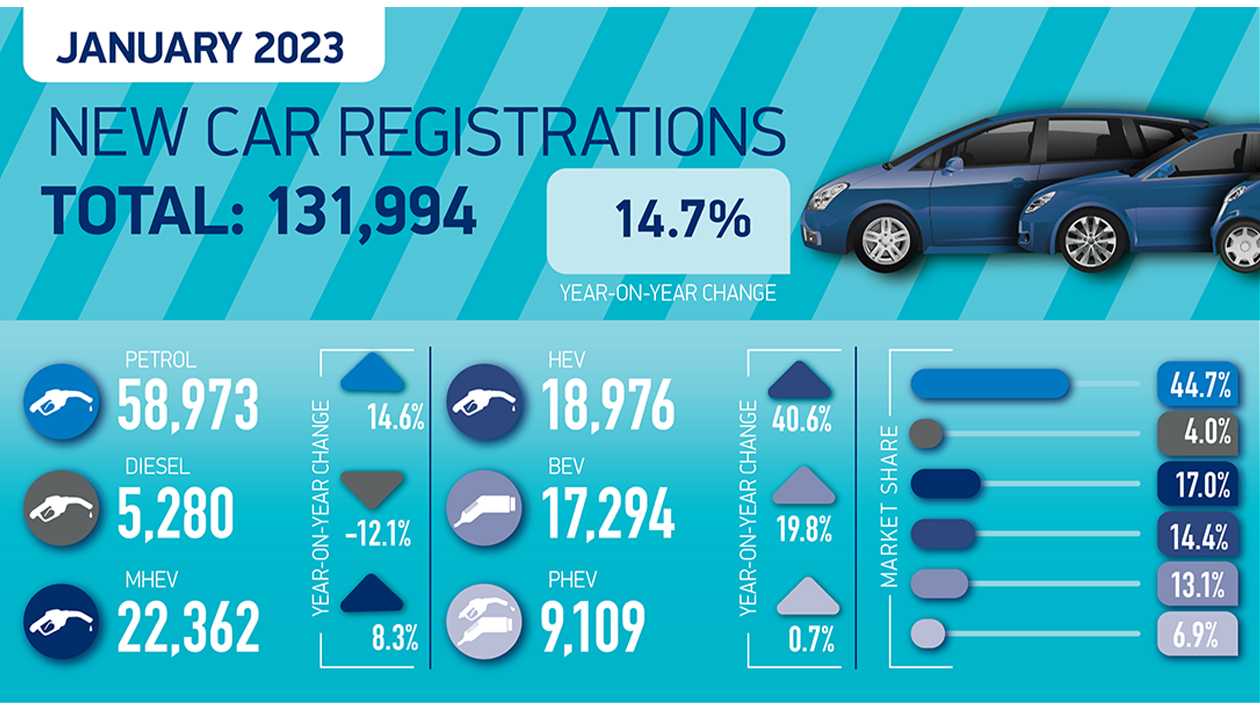

Sales of new electric cars in the UK continue to rise, with almost 250,000 new registrations in 2022; 38% more than in 2021. Despite this, EV market penetration has stalled. Reports show that at the end of 2021, 1/4 of new car sales were electric. Fast forward to the end of year 2022, when EV sales accounted for one in seven.

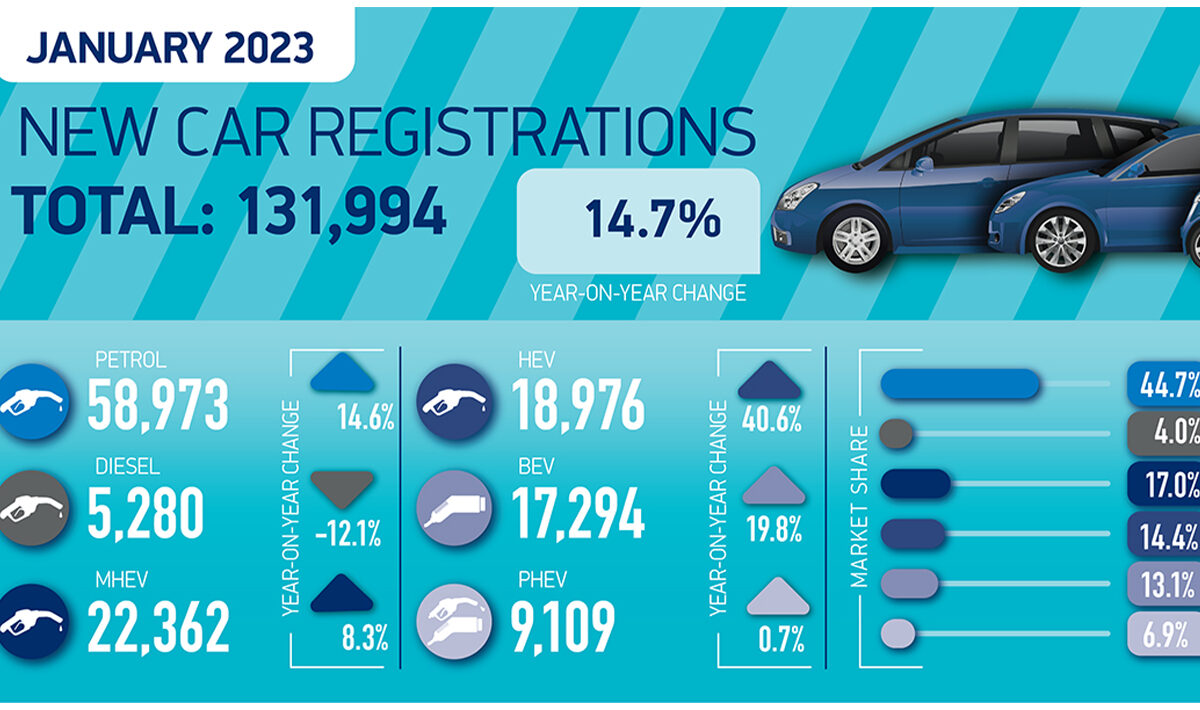

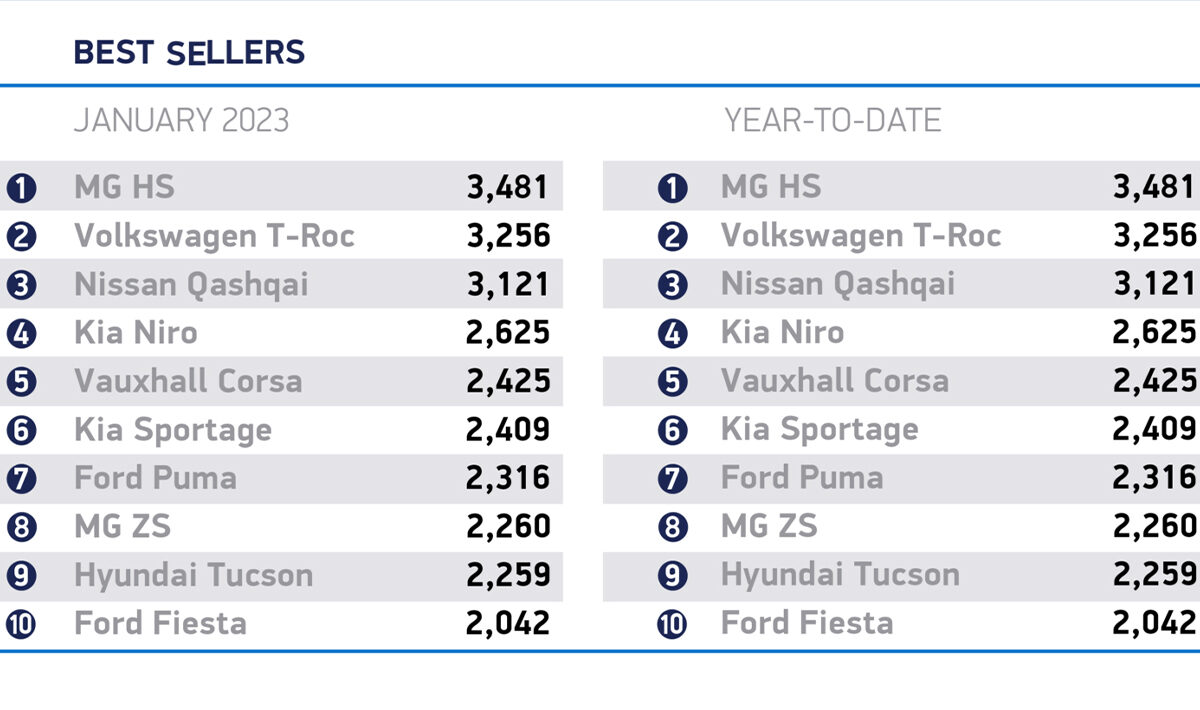

The latest data from the SMMT (Society of Motor Manufacturers and Traders) on new car registrations did reveal progress, showing EV market penetration rose by 19.8% since January 2022. Still, with buyers experiencing delays due to long delivery times, it’s uncertain whether the increase represents greater demand for EVs or just delayed orders finally arriving with customers.

Fuel sensitivity has a huge impact on EV sales, especially on people searching for them. When fuel prices were almost £2 per litre back in the summer 2022 – making news headlines across the country – consumer appetite for EVs skyrocketed.

Fortunately, fuel prices have since fallen and stabilised, but energy costs have soared and rising electricity prices has rapidly depressed demand for new EVs. With supply constraints leading to long delivery lead times, the decline in interest may indicate stalling new EV sales throughout the rest of this year. If true, the road to 2030 will slow.

Interest in new full and mild hybrid cars ahead of EV

With consumers interested in new EVs lowering, the demand for new full and mild hybrid vehicles has risen. Reports show that nearly a quarter of all new car searches online have overtaken interest in electric vehicles. I can also tell you that when we as a family recently (Jan 2023) wanted to purchase a new car we went hybrid. We as a family are not convinced Electric will work for us.

Electric is changing the brand landscape

Currently, one of the winning companies in the EV revolution is MG. Despite only holding a 3% share of the new ICE (Internal Combustion Engine) market, it receives 33% of all EV leads. For example, the MG4 demonstrates the demand for EVs when upfront costs are lowered. Unsurprisingly, with a starting price of 26k, MG4 is the most viewed of any new EV online in the last quarter of 2022.

It’s not just MG that are reaping the benefits of EV sales; brands like Hyundai, Kia, and Nissan have reinvented themselves in the EV space. They all have a bigger market share than in the traditional ICE market. Even Tesla have reduced their car prices in 2023 (twice at the time of writing).

Preserving interest remains a challenge for brands

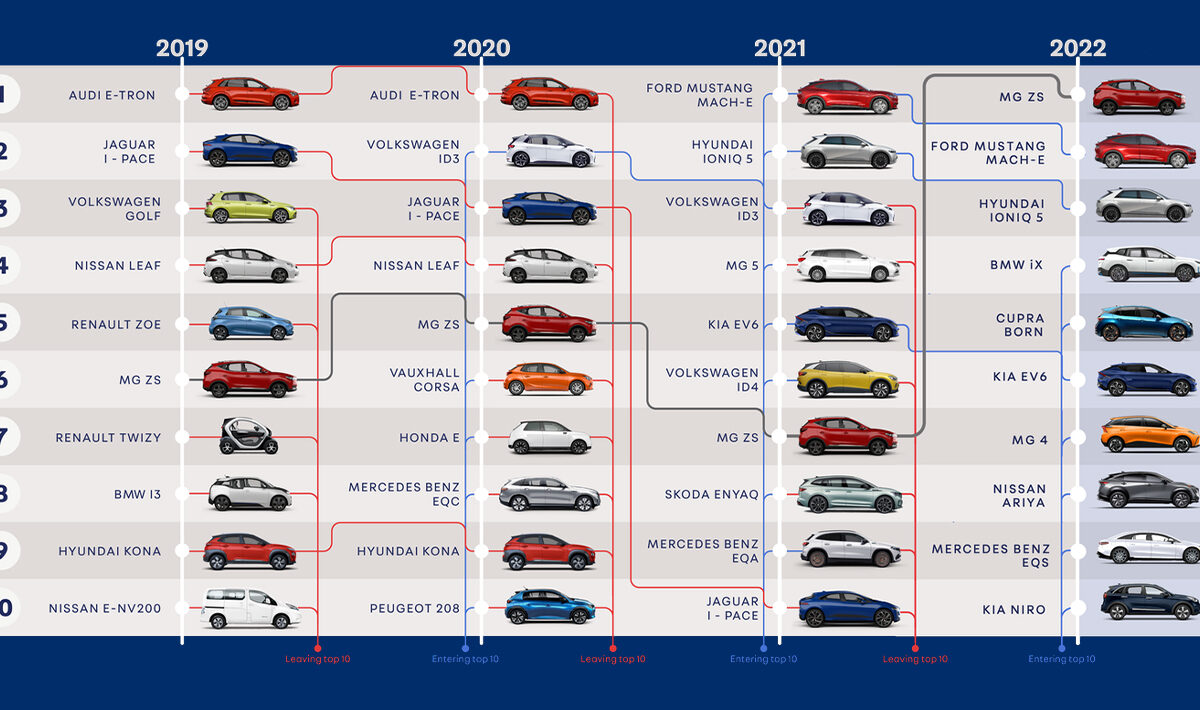

With more electric models coming into the market, staying at the forefront of car buyers’ minds becomes a tougher challenge, especially with the hindrance of supply constraints.

The Ford Mustang Mach-E and MG ZS have achieved this by generating the most views of their new car advert over the course of 2022. At the opposite end, other models like the Fiat 500e, Volkswagen ID.3, and Mercedes-Benz EQA have all dropped out of the top 10 ranking.

Car buyers’ choice remains limited despite new model launches

2022 was a strong year for EV model launches; ranging from incumbent brands like Toyota unleashing the bZ4X (their first electric model), to new entrants like GWM (Great Wall Motors) with the Ora Funky Cat.

There are now 73 new EV models to choose from in the UK, though the amount available to buy remains limited in comparison to every other areas of the market. The ICE market has 272 petrol and 107 diesel options. Even the plug-in hybrid market has more options.

Achieving mass adoption requires more affordable options

There’s still a massive disparity between the number of electric and ICE models in lower price bands.

If you’re a new car buyer with less than £30k to spend, the electric options available are really limited, with 10 times more ICE models to choose from. The UK needs more affordable options if it wants to achieve mass adoption and appeal to a more mainstream demographic.

Running cost savings remain but the upfront price gap widens

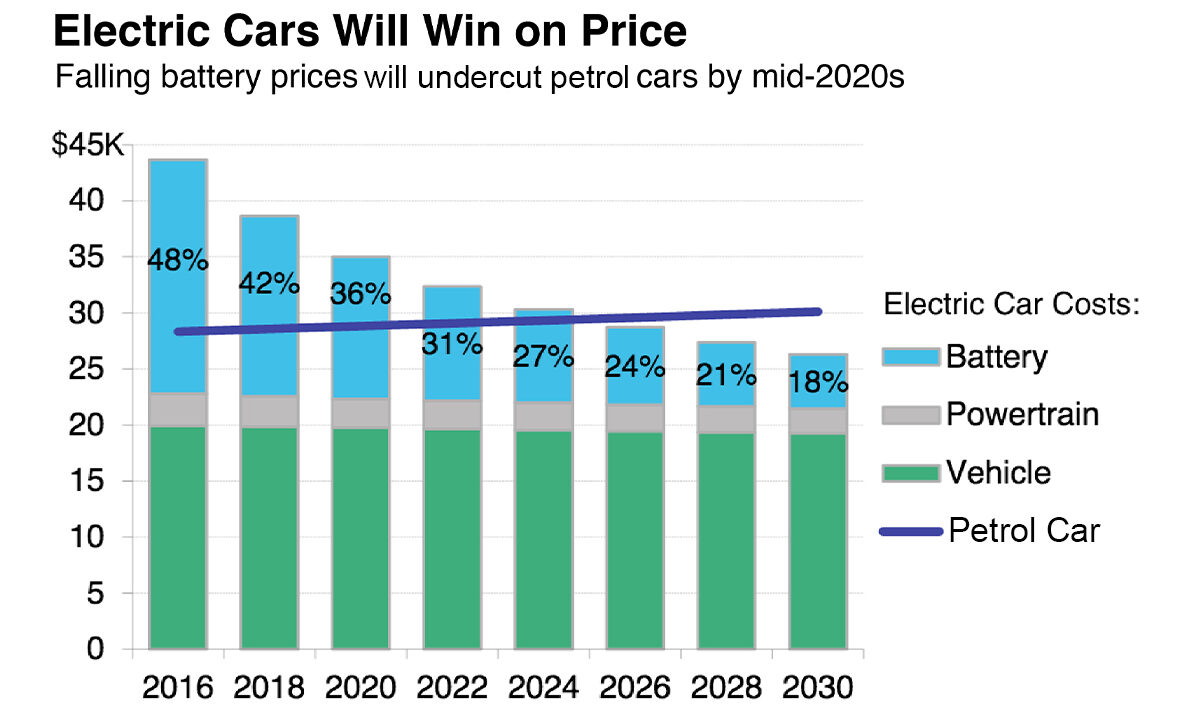

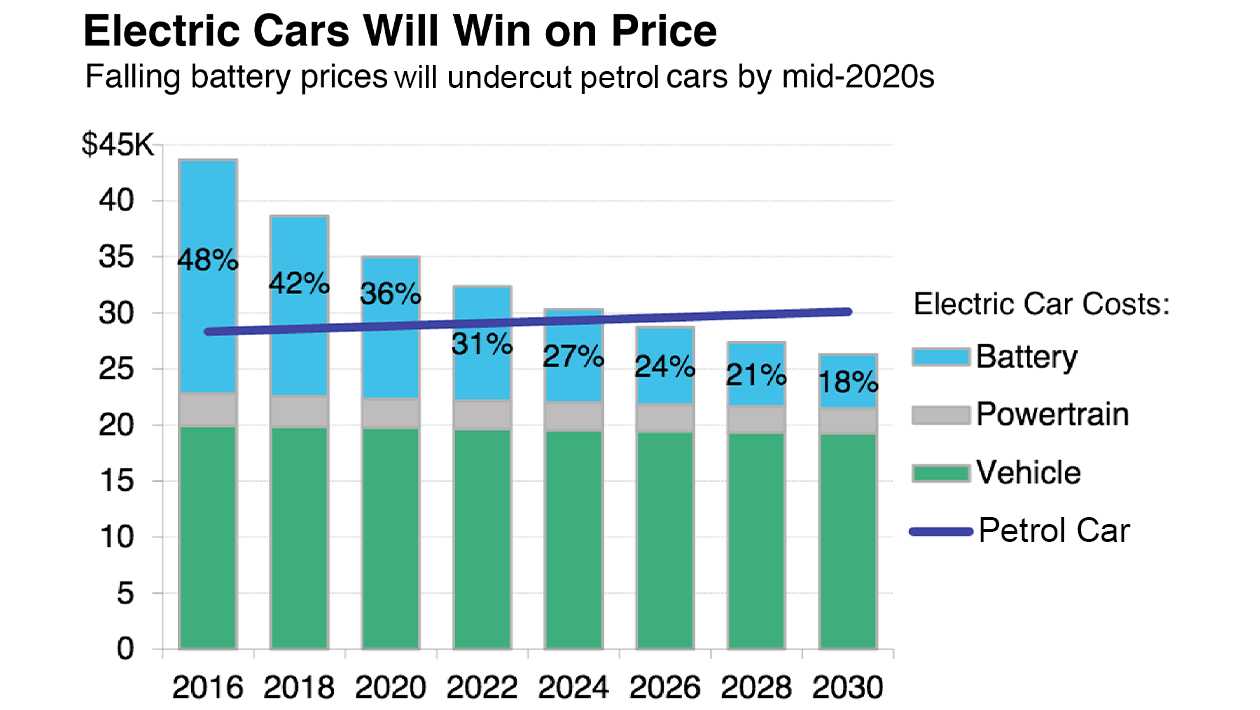

Reports show that the upfront cost remains the 2nd biggest barrier to entry with 36% of people saying that it prevents them from buying an EV. On average, a new electric vehicle is 36% more expensive than a comparable petrol or diesel car; 2 percentage points higher than the last quarter of 2022 and 4 percentage points higher than a year ago. According to reports, this is due to the rise of electric car battery prices for the first time in more than 10 years. However, forecasters predict batteries will drop in price over the next decade.

EV owners are saving £124 per 1,000 miles on running costs

When petrol prices neared £2 per litre last summer, the saving on running costs were £165 per thousand miles. Despite that fallen peak, EV owners can still save £124 per thousand miles driven if they have a home charger (with more savings for households with an off-peak charging tariff). Even without the Government’s energy price guarantee, electric vehicle owners with a home charger would still be saving £80 per thousand miles.

Notwithstanding, the saving on running costs will be far lower for those with no driveway, because relying on public infrastructure is expensive – making the move to electric even less appealing.

Higher upfront costs prevent mainstream adoption

Despite the launch of the Citroen Ami and MG4, EVs remain the preserve of the wealthy, with reports suggesting the typical EV buyer being wealthier and older than the average car buyer. As electricity prices rise and the upfront costs being higher, EVs are even more out of reach for the majority of car buyers, stretching way beyond typical budgets.

On top of this, there is a risk that those early adopters become saturated, with the wealthy buyers in this section decreasing over time. The industry needs to engage the next wave of electric vehicle buyers, else there’s a real possibility that sales of new EVs slow even further in the future.

Used EV market feeling the pressure for the first time

High costs in the EV market mean mainstream car buyers are more inclined to search for a 2nd hand car, allowing them to make the switch at a more affordable price. Although upfront cost remains a major barrier to entry here as well.

Reports show that the current retail price of a year-old EV is £10,000 higher than a comparable ICE vehicle, based on the stock advertised on trading sites. This results in the majority of people considering 2nd hand EVs being older, wealthier, and more affluent. Taking this into account, those searching for an EV are most likely considering both new and used options.

If you’re considering the purchase of a used EV, it’s crucial to carry out a comprehensive vehicle check before doing so. This history report includes various points such as the car valuation to ensure you are paying a fair market value and obtaining details about any past incidents of being written off.

Supply of used EVs has overtaken demand for the very first time

Demand for used electric vehicles has mirrored a similar trend to new, with an increase in searches in summer 2022 when fuel prices approached £2 per litre, followed by a fall in searches as electricity prices soared.

The more concerning trend, though, is the souring supply of used EVs. In 2022, the amount of 2nd hand EVs advertised online doubled as more stock returned to the market. This has led to the supply of used EVs outpacing demand for the first time. To put that into context, almost 5% of all under five-year-old used cars on a popular online car trader are now electric, but only 4% of the used cars viewed are electric, and they make up only 3% of the enquiries sent to retailers.

Used EV stock growing fast across brands

Most brands have seen their used EV stock double in 2022, but some models are returning in greater volumes than others, such as the Tesla Model 3, which saw stock levels triple since January 2022.

The most available used EV in the market is the Nissan LEAF, with 1,769 available to buy on a car trading site in December 2022.

Used electric vehicles are the slowest selling fuel type

Throughout 2022, EVs were the fastest-selling fuel type in the used car market. In the summer, an EV took just 23 days to sell on average, as fuel prices pushed £2 per litre.

Now though, with supply ahead of demand, used EVs are sitting on forecourts for longer. In fact, reports show they are the slowest selling fuel type, selling every 35 days in November.

Retailers beginning to lower used EV retail prices

Due to EVs sitting on forecourts for longer, retailers have begun cutting their retail prices. For three months in a row, used EV retail prices have fallen every month, whereas petrol and diesel prices have followed seasonal trends.

Some EV models with an oversupply of used vehicles are being reduced greatly in price by many retailers, including the Renault Zoe and Tesla Model 3, but this isn’t the case for all models.

New car PCP payments may increase if prices fall further

If the used car market dynamics are ignored, it will undoubtedly slow the road to 2030. Let’s suppose that used EV prices continue to fall – not due to lower battery costs – but because of overstock and lower demand, then margins will be squeezed and the need to stock used EVs will fall further.

Forecasters that determine future valuations on vehicles will alter their estimates to account for this value drop, passing the larger cost of depreciation onto the new car customers through bigger PCP payments. This, in turn, will make new electric vehicles more expensive and slow new electric car sales in the future.

Supply is going to rise rapidly over the next decade

Looking forward, used EV values will remain dependant on supply and demand dynamics. Whether or not demand will keep pace with supply is something only time will tell, as the amount of EVs registered continues to increase over the next decade.

The latest projections say there will be over 1 million electric vehicles on the road in the UK by 2024, a 600k increase from the amount at the end of 2021. By 2030, there will be nearly 8 million registered, which will be nearly a quarter of the total vehicles registered.

The rate of change will be more rapid in younger vehicles, with over half of all under-5-year-old cars on the road being electric by 2030. Fundamental changes will be needed as more used vehicles return to the industry, ensuring demand keeps pace with this predicted growth of supply.

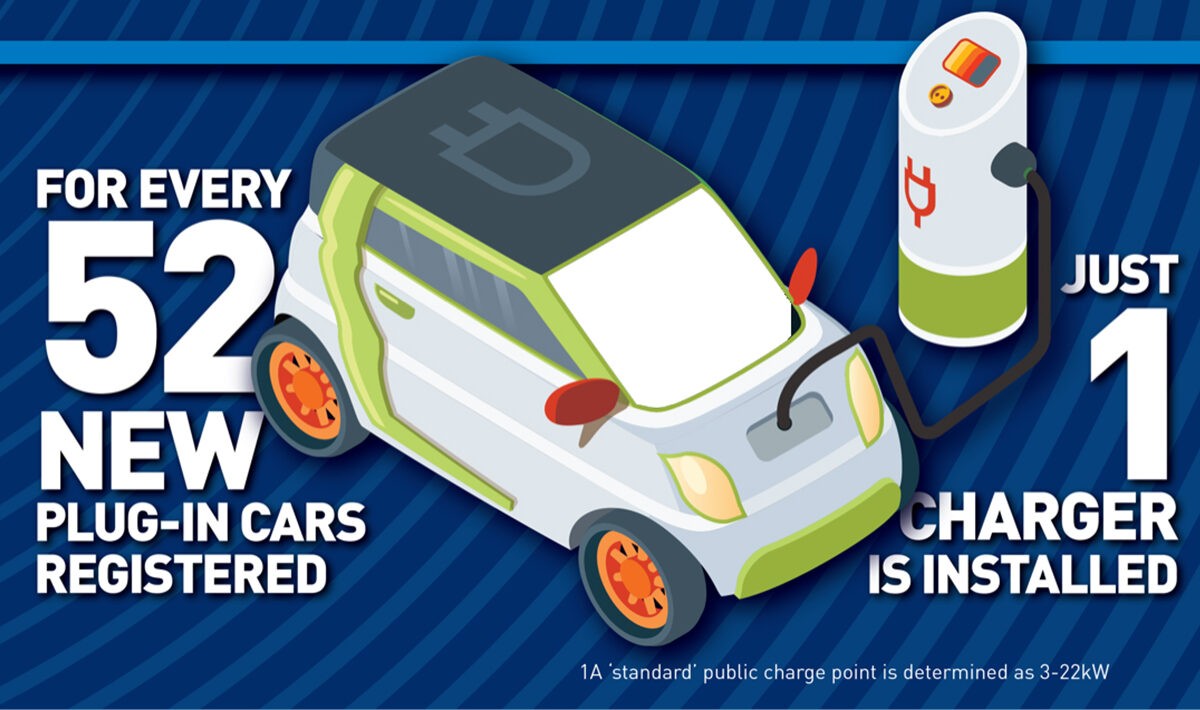

Let’s take a look at how the accelerating rollout of public charging infrastructure will be one of the most vital ways to support the used EV market.

Public charging infrastructure expansion has slowed

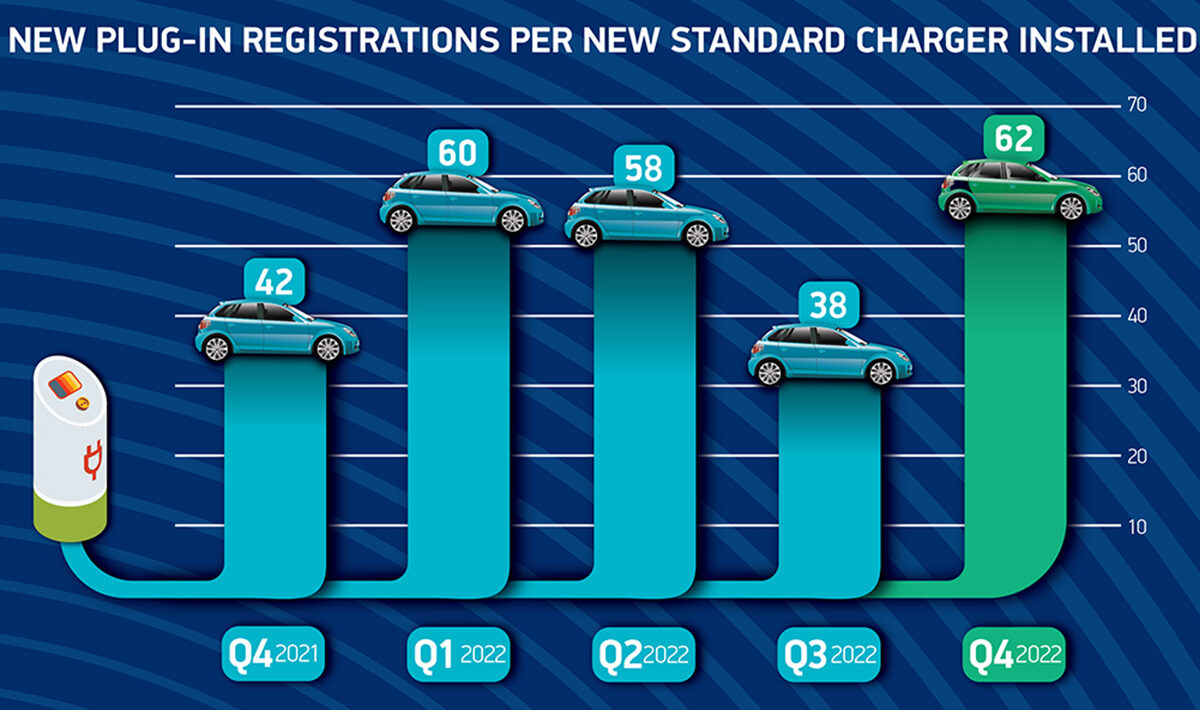

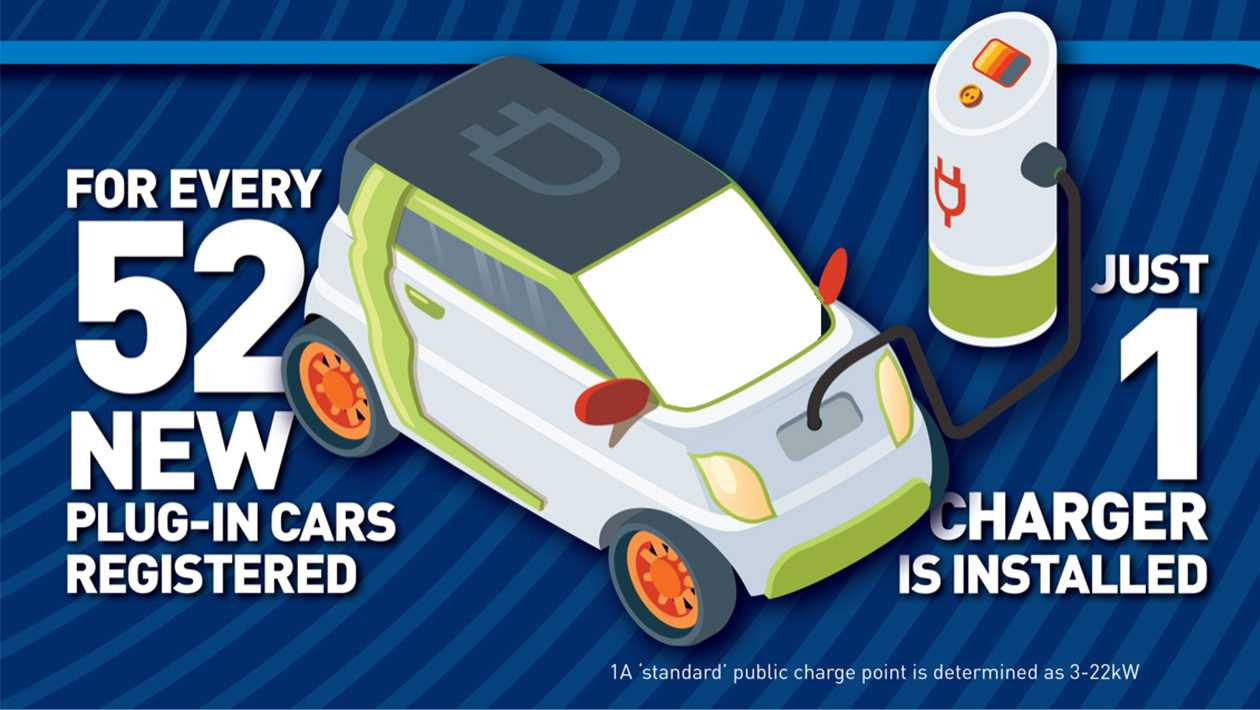

The number of public charging devices, like EV registrations, has continued to increase. At the end of 2022, there were 36,752 across the UK, totalling a 33% increase over 2021. The Government targets a total of 300,000 public charging devices by 2030, nearly eight times more than are available today. To achieve this there will need to be a faster rollout.

The number of EVs on UK roads has been more than the rollout of public charging infrastructure since 2020, though it must be highlighted that most of these registrations were by EV owners with a home charger (who rarely use public charging). Targets need to met over the next decade to meet the requirements of owners without access to a home charger.

As those buyers with home charging capabilities diminishes, there will be a higher need for accessible, reliable, and low cost public charging infrastructure that has a much greater utilisation rate than seen today.

Overcoming the obstacles

No entity or single action is going to solve all the issues facing the EV market. It’s the responsibility of the entire industry, the government, all energy companies and charging operators to make the EV switch a viable solution for the population.

Here are three fundamental areas for us all to focus on:

Making the switch to EVs more affordable

It may well take years until the cost of batteries drop below the level needed to achieve price parity, yet there are still actions that can be done to make electric vehicles more affordable in the short-term.

- Frame EVs ownership on a monthly total cost basis, to reduce upfront costs concerns.

- Allow bundled finance packages that include the vehicle, charge point, and energy tariff in a recurring monthly payment.

- Offer leasing deals, which are usually cheaper than PCP (15% lower than PCP, on average).

Creating trust in 2nd-hand EVs

As supply is currently ahead of demand, the used EV market needs urgent attention to counter the imbalance.

- Use data to source used EVs that will sell, on a spec and model basis for the local area

- Introduce battery certificates and health checks, which could be highlighted by sellers to dispel concerns over battery degradation.

- Follow the example of other countries, like the US and France, in supporting lower income households ability to purchase used EVs.

- Retailer sales and service staff need to be trained to promote the benefits and differences of electric vehicles, from charging solutions to regenerative braking. This will include sales teams driving 2nd-hand electric vehicles to build their confidence.

Acceleration of the public charging infrastructure rollout

The UK needs a reliable, low-cost, and accessible charging solution for those consumers without a home charger and taking long journeys. Until this is resolved, a big proportion of UK households will not be able to switch to electric.

In Summary

Despite current sales figures looking positive, reports tell us there has been a decline in consumer appetite for EVs, leaving the market on thin ice where mass EV adoption is concerned. The imbalance of supply over demand, along with high costs, results in the market facing a worrying combination of factors which may well cause major diversions on the EV road to 2030, unless the industry and government take action.

However, with running costs still in EV’s favour, and with more cheaper models in the pipeline, especially those from Asia, there are positive signs ahead.

Read more on

Would you like us to review a product, service or car?

Get in touch and we can make that happen for you.

Find out moreRelated Stories

Advertisement Advertisement

Advertisement Advertisement

Advertisement